A Look Into Whitman’s Endowment

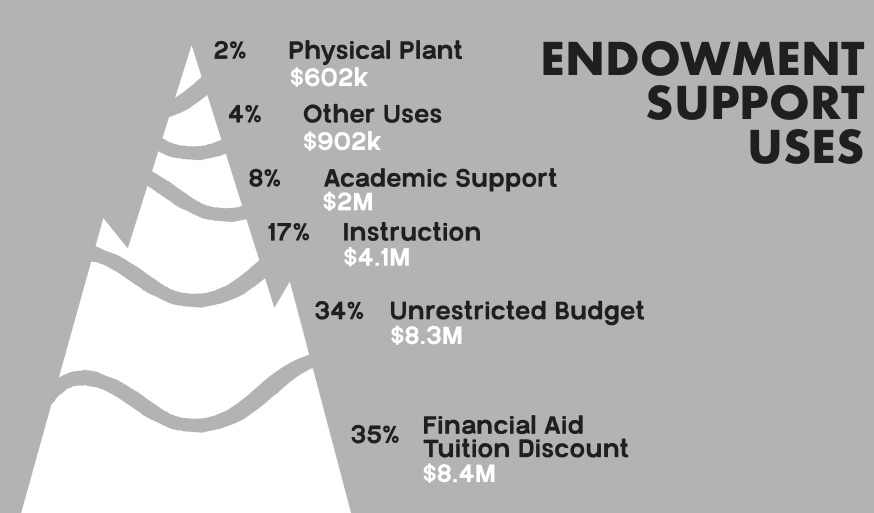

This graph depicts the breakdown of how the endowment was spent in the 2017 fiscal year. It should be noted, however, that only five percent of the total endowment was spent in that time period. Infographic by Peter Eberle.

May 3, 2018

Editor of The Wire Radio Hour Andrew Schwartz sat down with Politics Major Meg Rierson ‘18 for last week’s show to discuss her thesis “Endowments and the Elite: A Political Economic Analysis of the Whitman Endowment.” Seeking to examine whose interests the Whitman endowment really serves, Rierson combined an analysis of interviews with those involved in the financial activities of Whitman with the work of various scholars on late capitalism, higher education and financialization.

This interview has been edited for length and clarity.

Whitman Wire: Can you give a brief overview of Whitman’s endowment and what endowments are in general?

Meg Rierson: An endowment is a pool of donations to the college usually in the form of checks or financial instruments like stocks or bonds. The point of these donations it to accumulate steady returns for the college in perpetuity – so, forever. Endowments, broadly, have been used historically for the financial security of colleges, but as higher education has been changing a lot more – institutions have been orienting a lot more towards branding and marketing – endowments have become a marker of prestige. This is especially the case at big schools like Yale and Harvard, where their endowments are huge: tens of billions of dollars. Whitman, specifically, a lot of big figures in the College’s [history], like Stephen Penrose and Chester Maxey who talk a lot … about how the endowment is their priority. How they really want [the endowment] to get bigger – they really need it to get bigger – so that the College looks better and can be more competitive with the New England Liberal Arts elite schools.

WW: So it’s wrapped up in this idea – I mean you mentioned this in your presentation [Rierson presented her thesis at the Whitman Undergraduate Conference] – of Whitman continually trying to emulate and be more like these East Coast counterparts that it can never quite match … You mentioned Yale’s massive endowment and you said Whitman’s is [about] 500 million [Whitman’s endowment value, as of FY2017 is $518,496,000], and 30 years ago it was like between 100, 200, 300 million. So it’s like a new thing at Whitman.

MR: Yeah, that’s a really good point. Definitely there’s a rapid growth of endowments broadly in the U.S., but also specifically Whitman it has been a pretty recent trend, so it’s around the 1970s and ‘80s when a lot of scholars mark that endowments had really massive growth, because growth was the name of the game.

WW: So it wasn’t just that the investments were generating higher returns – much more money was going into the endowments in that period?

MR: It’s both of those things. So not only were donations increasing – donations to Whitman, even in the past few years, have increased a lot. But it’s also the result of colleges choosing to invest in riskier asset classes. So it’s not just that Whitman was invested in bonds for the entire history of their endowment and that all of a sudden in the ‘70s and ‘80s bonds were doing really well. It’s that we oriented towards investing in higher risk but higher reward things, like private credit or private equities. Something like 20 percent is the combined portion that private credit and private equities make up of the endowment, which is a sizeable portion given that they’re pretty risky investments.

WW: Is that pretty standard in terms of schools like Whitman?

MR: In a lot of my readings – just different articles that are published about endowments – a lot of scholars are talking about how more and more schools are orienting towards private equities, private credit instruments. Whitman wasn’t as affected by this, but a lot of schools were hit hard by the 2008 financial crisis, because they were investing in those really risky mortgage bonds.

WW: I’m interested now in your critique of Whitman’s [endowment]. It sounded like a lot of what you took issue with [in your thesis] was the way Whitman represents its endowment. You said five percent of it [annually] is spent on college operations, financial aid, etc. and there’s often this critique, it sounds like, that not more of it is dispensed, and it has to do with [the fact that] we need it to last in perpetuity. What is the issue that your research focuses on?

MR: The problem that I had was endowments were often represented as – at Whitman specifically – as a way of subsidizing the real cost of a Whitman education. That if we didn’t have an endowment, tuition would be 30 percent higher, or if the Republican tax plan got passed – where Whitman’s endowment would be taxed – it would be financial aid that would be hurt the hardest. Financial aid keeps coming up as the thing that the endowment does in my conversations with people. But that seemed disingenuous to me when you look at the actual numbers, because financial aid comprises 35 percent of five percent of the larger 518 million. So when Whitman develops their very austere spending rule of only spending five percent of their total endowment, then 35 percent of that is spent on financial aid, which leaves over 9 percent of those dollars that aren’t going toward financial aid, that aren’t going towards subsidizing a Whitman education … It seems disingenuous to me to market it that way … because those other hundreds of millions of dollars are doing something. And what I argue in my thesis is that what they’re doing is contributing to the trend in higher education of colleges focusing a lot more on financial accumulation and the appearance of prestige rather than notions of equity or access … It seemed to me that what the endowment is doing is contributing to the exclusivity and elitism that has been baked into the history of Whitman. In the history of the College that Tom Edwards writes, this idea that a Whitman education is not for everyone – that the liberal arts are not for everyone – is really prevalent from all of the major presidents of the college, and they sort of centralize the endowment in completing that mission. The endowment is there to provide financial aid, but it’s also there to make the college look good, and it’s also there to finance the kind of lifestyle and the kind of experience that Whitman students are used to, and that experience is necessarily a very exclusive one.

WW: Can you talk a little bit about why the endowment is so wrapped up in prestige? You mentioned it has to do, in some regard, with comparing ourselves to these East Coast schools.

MR: I think endowments and prestige have a longer more historical relationship than it seems right now. In the current moment of late capitalist accumulation – American society depending on finance and the kind of financial operations that endowments engage in – it can kind of seem as if the association between a college having a ton of money and looking good is new. But if you look back at the history of the College, Penrose was really concerned that we weren’t going to get enough students to come here because we didn’t look good enough, or we weren’t going to get enough donors to donate to sustain the College because we didn’t have an endowment that was big enough. So it’s sort of a vicious cycle because if your endowment isn’t big enough, what you need is donors, but if your endowment isn’t big enough, donors don’t want to donate because they don’t have faith in the institution. Another way that endowments are aligned with prestige is that the minimum donation to create an endowment – a smaller endowment that makes up the larger endowment – is $50,000. So, what you’re looking for when you’re looking to grow your endowment is people who are often graduates of the college, who have made enough money and who are financially secure enough, who then want to reproduce their experience at Whitman.

WW: It sounds like you’re saying something very subtle here. You’re not saying having an endowment is bad.

MR: I don’t want to burn the endowment to the ground. I get that it’s really big part of the financial infrastructure of the college … One of the things that people who study endowments talk about is that endowments promote intergenerational equity, which is just the idea of maintaining the current experience at Whitman for generations to come. But something doesn’t sit right with me about the word equity in a liberal enclave like Whitman, where [the word] connotes ideas of expanding access or helping traditionally disadvantaged groups – that is not really what [the endowment] does. It retains equity for a very specific sect of society to continue having that experience within that sect of society. Endowments can provide a lot of financial aid, that money has so much potential, it’s just that the way that colleges have viewed them as like, “We need to keep this money, we need to keep the principle so that it keeps growing so that we look good,” sort of detracts from the idea of, “Wow we actually have all this money – we could do so much with this.” Five percent doesn’t have to be the number that we spend just because other schools spend it. Obviously there’s so much power in money, and if Whitman is going to continue with this Strategic Plan idea of increasing access and affordability at this school and try to use “diversity” and “inclusion” and “access” as all these buzzwords, as how they want to market themselves … then I think the endowment is a good place to look at as a start … The whole point of the thesis was to look at whose interests the endowment really serves.

Morgan Shimabuku • Mar 8, 2019 at 2:57 pm

Great interview and great insight into Whitman’s endowment by Meg Riersen. I hope that Meg has passed some recommendations on to Whitman administrators for consideration. And I hope they listen!

As an alum, it makes me wonder whether or not I should donate to the endowment if I specifically want my money being used for financial aid, increasing equity across more social classes, and improving diversity of the student body. Are there other ways to go about doing this (other than setting up my own endowment/scholarship fund, which I do not have enough wealth to do)?

On a side note, I have been withholding donations for the past several years in order to support the fossil fuel divestment campaign, but now that the Board of Trustees have come around on that, I have less hesitation about sending my money to support my alma mater.