According to the Whitman College Financial Aid Web site, during the 2008-2009 academic school year 46 percent of the student body received need-based gift aid. In the same year the average need-based financial aid package added up to $29,841. The figures for this year have not yet been posted.

As tuition increases and the school continues to make the budget cuts that began last year, students with on-campus jobs are finding it difficult to make the money they had expected. Ruth Mattmiller, a sophomore who works as a carpenter in the theater scene shop, explained that the shop staff was informed that, due to budget cuts, they would not be allowed to work the same amount of hours as they had previously.

“Because of budget cuts to the theater program,” Mattmiller said in an e-mail, “we can no longer work more than six hours per week, which greatly affects us financially in general.”

Mattmiller’s passion for theater is evident despite her worry about budget cuts to the department. While a decrease in income has become a major factor in whether she will live on or off campus in the coming year, it is not her greatest concern.

“[I must] consider getting another job, possibly at the cost of having to quit my job in the theater, which I would hate to have to do,” said Mattmiller.

Michail Georgiev, a sophomore from Bulgaria, expressed similar concerns. Georgiev works in the Harper Joy scene shop as well as the Baker Ferguson Fitness Center.

“I was told that budget cuts resulted in less shifts,” Georgiev said. “[I] barely managed to total eight hours of work a week, whereas last semester I was working 16 and a half.”

As an international student, Georgiev has expenses like international airfare that most other Whitman students do not have to factor into their budget.

“[Less work] means not only less opportunities to eat off campus and shop for necessities, but it also means that I can pay a smaller part of my airfare to the United States, which is a big part of my family’s annual expenses,” said Georgiev.

With fewer opportunities to make money on campus, Georgiev juggles two jobs, along with his academic requirements and his extracurricular commitments to the Harper Joy Theater and the Beta Theta Pi fraternity.

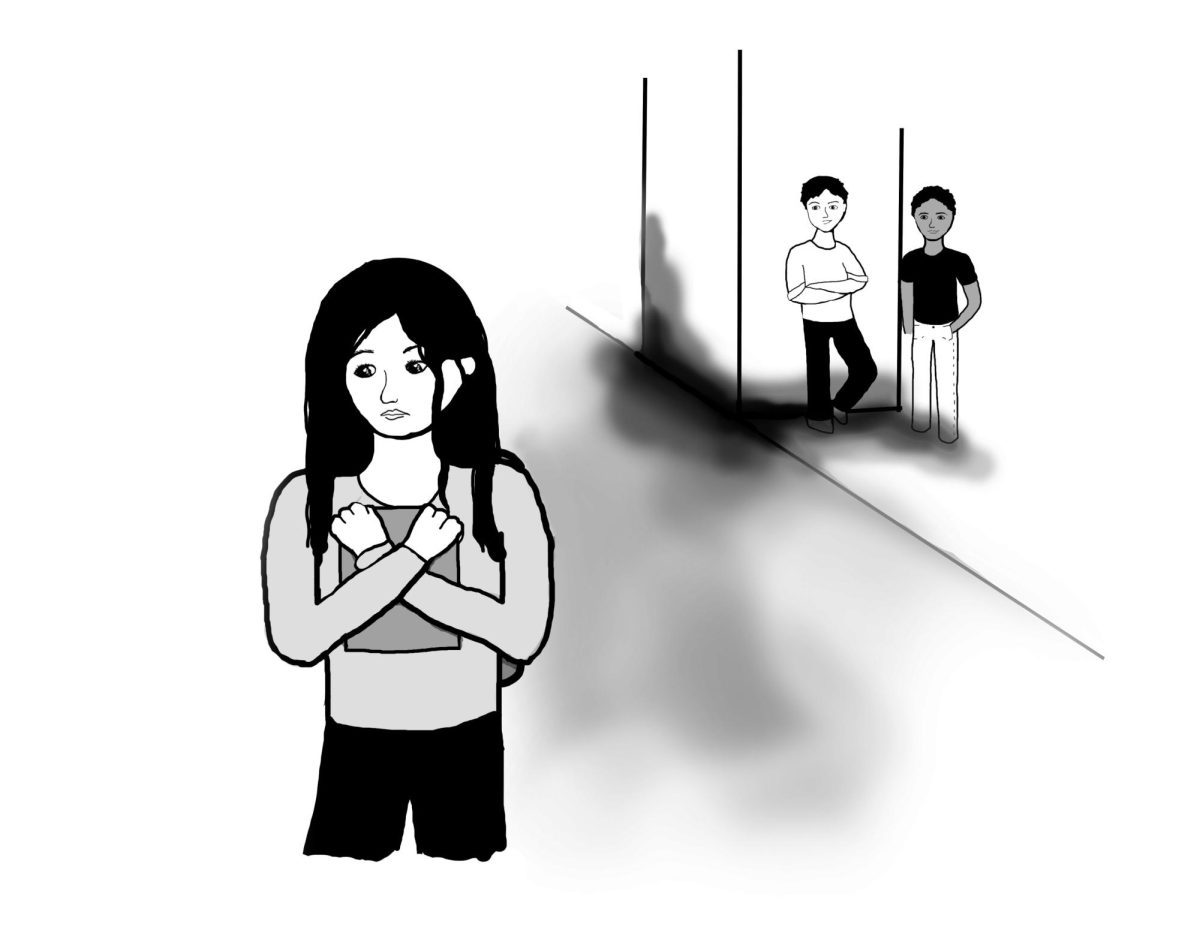

For some students, frustration arises not over the specifics of on-campus jobs, but rather the attitude towards student economics in general. First-year Lillian Bailey expressed her concern with the student population’s reluctance to discuss issues of money with their peers.

“Whitman students [feel] like they need to be overly P.C. . . . people would rather not say anything at all than put something out there that’s controversial,” Bailey said.

Bailey went on to say that this reluctance to talk about economic issues amongst friends makes for stressful social dynamics.

“When so many people are hurting: struggling with financial aid: it’s difficult for people who have different economic backgrounds to talk about it and relate.”

While 78 percent of Whitman students receive some form of aid for their tuition, the other 22 percent pay all expenses. For many of the students within that 78 percent, attending Whitman would not be possible without monetary help from the government and the school.

As our nation struggles through economic crisis, social and academic life goes on here at Whitman. In order to ease the pressure that many students feel over issues of money, Bailey believes that it is better to confront the issues head-on.